La historia de inversión de Vanguard

Mejores inversiones por diseño

Dado que Vanguard ha sido propiedad de inversores desde su fundación en 1975, nuestros intereses siempre han coincidido con los de nuestros inversores. Por eso, nuestro enfoque de gestión de inversiones se centra inquebrantablemente en el éxito de nuestros clientes. Utilizamos métodos y principios comprobados para impulsar el rendimiento de inversiones verdaderamente duraderas.

Cambiando la forma en que el mundo invierte

Duración del vídeo: 1 minuto 37 segundos

Greg Davis, director de inversiones de Vanguard, ofrece su perspectiva sobre el enfoque de Vanguard hacia la gestión de activos.

Transcripción del vídeo:

Gregory Davis: El cliente es lo que realmente nos rige en nuestro trabajo diario. Queremos asegurarnos de que ofrecemos un rendimiento acorde con lo que el cliente espera desde el punto de vista del riesgo, el rendimiento y, en última instancia, sus objetivos.

"Nos centramos en lo que es mejor para nuestros clientes a lo largo del tiempo".

Greg Davis

Director de inversiones

¿Qué hace que nuestro enfoque de inversión sea único?

Buscamos continuamente oportunidades para reducir el costo de nuestras inversiones. Las investigaciones muestran que las inversiones de menor costo superan a las alternativas de mayor costo, lo que significa que cuanto más reduzcamos los costos, mayores serán las posibilidades de éxito de los inversores. 1

La escala, la disciplina y el historial de desempeño de Vanguard nos han permitido atraer a profesionales de inversión altamente talentosos. Nuestros gestores de inversiones en todo el mundo aportan una gran experiencia, experiencia y trayectoria diversa a nuestro enfoque de inversión comprobado.

Nuestro enfoque ofrece valor a largo plazo más allá del rendimiento. Brinda confiabilidad, consistencia y estabilidad que han sido de gran utilidad para nuestros clientes durante décadas.

1 Wallick, Daniel W., Brian R. Wimmer y James J. Balsamo, 2015. Comprar Alpha: obtienes lo que no pagas . Valley Forge, Pensilvania: The Vanguard Group.

A wide array of enduring ETFs and mutual funds

Molly Concannon, head of equity product, and Matthew Brancato, chief client officer for Vanguard Institutional Investor Group, discuss how we develop our diverse investment lineup.

Video length: 1 minute 48 seconds

Video transcript:

Matthew Brancato: An enduring investment idea is one that over the long term improves the chances that an investor will be able to realize their goals. It's good to just start and think about what it is that makes a product enduring in nature and how that separates from the idea of a fad.

Made to last

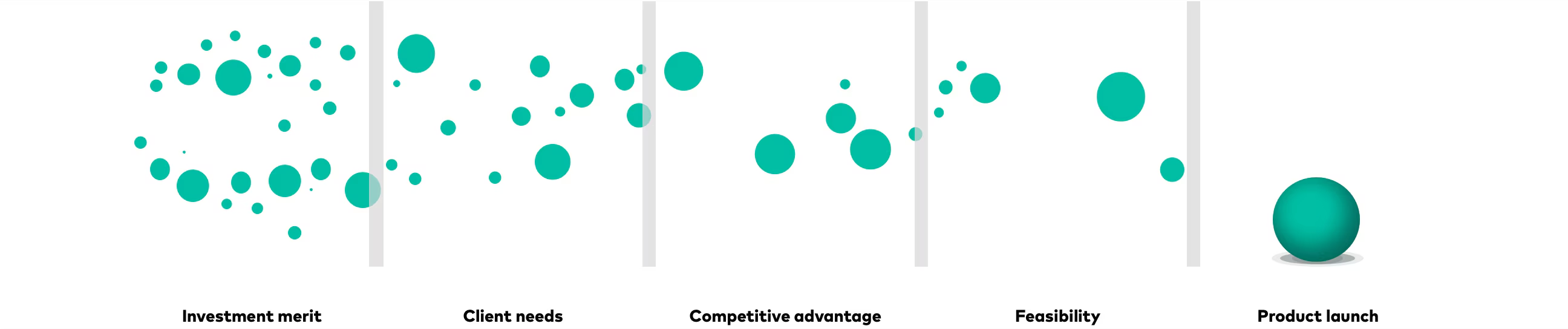

A rigorous process guides every product launch

All of our mutual funds and exchange-traded funds (ETFs) are built for the long term and designed solely with our clients’ needs in mind.

We weigh each product idea against a consistent set of standards to help us determine which products to launch. The following process guides our decisions:

As we evaluate product ideas, we ask ourselves these questions:

Does the product have enduring investment merit?

Vanguard avoids speculative investments and short-term fads. Instead, we focus on asset classes that earn positive, real returns from dividends, interest, and other sources of regular cash flows.

Does the product fulfill the long-term needs of its targeted clients?

As a global company, we don’t take a one-size-fits-all approach to launching products. Instead, we adhere to a targeted strategy. We aim to launch products that satisfy the needs and preferences of specific client types—and we also evaluate clients to ensure that the product is appropriate for their long-term interests.

Can we deliver a compelling advantage over competitors?

Vanguard is known for its pioneering funds and long-term outperformance. We thoroughly assess the attributes of each product with the goal of introducing those that will stand out in the marketplace and have the long-term success our clients have come to expect.

Is it feasible to launch the product?

We will launch a product only after a thorough analysis of any legal and regulatory constraints, along with any risks we may face.

All Vanguard products are designed and vetted using this structured, disciplined approach, which aligns with our client-first philosophy.

That philosophy is rooted in our unique investor-owned organizational structure, which aligns our interests with those of our clients.2 This enables our low-cost investment ethos and long-term perspective.

2 Vanguard is owned by its funds, which are owned by Vanguard’s fund shareholder clients.

Our active roots and capabilities

Diversified sources of alpha, differentiated risk framework.

Video length: 2 minutes 31 seconds

Video transcript:

Arvind Narayanan: Our active fixed income process at Vanguard is really built around three key tenets. First, having a long-term perspective. Second, is to have diversified sources of alpha, where we're not reliant on a single market risk factor to drive returns in the portfolio. And third, is to have a disciplined approach to risk taking, where our cost advantage gives us that benefit and allows us to be patient and take risk in the market only when the opportunities are there.

A history of enduring funds and uncommon results in active management

Vanguard is one of the largest active managers in the world, with $1.8 trillion in actively managed mutual funds.3 And, as shown, the performance of our active funds has been consistently strong.

3 Source: Vanguard, as of November 30, 2024.

Notes: For the three-year period ended September 30, 2024, 6 of 6 Vanguard money market funds, 37 of 55 bond funds, 8 of 10 balanced funds, and 38 of 50 stock funds, or 89 of 121 Vanguard funds outperformed their peer group averages. For the five-year period, 6 of 6 Vanguard money market funds, 39 of 54 bond funds, 7 of 10 balanced funds, and 40 of 50 stock funds, or 92 of 120 Vanguard funds outperformed their peer group averages. For the ten-year period, 6 of 6 Vanguard money market funds, 42 of 44 bond funds, 5 of 5 balanced funds, and 31 of 39 stock funds, or 84 of 94 Vanguard funds outperformed their peer group averages. Only funds with a minimum three-, five-, or ten-year history, respectively, were included in the comparison. Results for other time periods will vary. Note that the competitive performance data shown represent past performance, which is not a guarantee of future results, and that all investments are subject to risks. For the most recent performance, visit performance.

Source: Lipper, a Thomson Reuters Company.

Our active funds, like all Vanguard funds, are built to meet our investment design standards. Designed to endure, they are managed by our talented in-house managers and proven external advisors. These experts research and apply fundamental and proprietary strategies with the goal of delivering long-term outperformance for our investors. The results speak for themselves.

Vanguard manages the oldest balanced fund in the United States, Vanguard Wellington™ Fund. It was introduced in 1929 and thrives today.

The professionals behind our index mandates

A global team focused on costs and execution.

Video length: 3 minutes

Video transcript:

Rodney Comegys: Vanguard's been doing indexing since the mid-1970s. Really Mr. Bogle (Vanguard founder John C. Bogle) made the first index fund for retail investors. From there, we've taken and expanded it. We were the first to offer international indexing, small caps, small company indexing, bond indexing, and emerging markets indexing.

Leading the way with pioneering index funds

For us, indexing is about more than just products. It’s central to our business. We are committed to indexing, and we persistently work to give our clients top-performing index funds without trade-offs. That means applying disciplined benchmarking and risk-management techniques while continually lowering operating and transaction costs.

A principled, timeless approach

Kaitlyn Caughlin, Vanguard's global head of investment management and finance risk, and Joe Davis, Vanguard’s global chief economist, explain the standards behind our time-tested approach.

Video length: 2 minutes 49 seconds

Video transcript:

Kaitlyn Caughlin: Vanguard has a very unique approach to investment management that has been built over a 40-year history around the global market. And we really define our investment management approach in three key ways. One, we have deep expertise. Two, we take a disciplined approach to risk taking. And three, we have global presence and perspectives. All of which join together to a proven investment approach that delivers value and outcomes for our clients, day in and day out.

Our proven approach to investment management

We have developed a broad but carefully defined selection of investments that continues to evolve as investor preferences and markets change. We partner with some of the industry’s top managers, maintain a disciplined mindset, and use our global scale to benefit investors worldwide.

Deep expertise

Vanguard attracts and retains experienced, passionate portfolio managers with diverse backgrounds and proven track records of producing strong outcomes for investors.

We put our current and prospective investment managers through a rigorous evaluation process that focuses on both people and technology. This multifaceted approach to manager selection and oversight emphasizes the attributes—both qualitative and quantitative—that lead to long-term results.

Our internal investment teams work in a collaborative environment that fosters timely interactions, promotes diversity of thought and idea generation, and ensures thoughtful decision-making and risk management.

We also work with well-respected, leading investment advisory firms, including Wellington Management Company, PRIMECAP Management Company, and Baillie Gifford. In keeping with our focus on the long term, we’ve built long-standing relationships with our external advisory firms. The average length is 13 years. Our longest relationship, with Wellington, has spanned more than 45 years.

15 yrs

Average external relationship

93 yrs

Tenure of oldest fund

47 yrs

Longest external relationship

All data as of March 31, 2023.

Disciplined risk-taking

Our long-term perspective affords us the patience to take risks only when both the rewards and the likelihood of success are greatest.

Our disciplined approach to risk is embedded in our culture; it informs every aspect of our investment style. For our fund managers—who are aware of rapid changes in markets and how those changes can affect their strategies—this discipline results in a team-based approach where risk management is built into the investment process.

A long-term perspective

Maximizing risk and rewards

A team-based approach

Building risk management into the process

Deep global expertise

Leveraging resources across the world

Global perspectives

Our scale and global investment management capabilities position us to give clients worldwide the potential to achieve long-term success.

Serving more than 50 million investors in Europe, Australia, the Americas, and China, Vanguard is truly a global firm.4 We combine our global infrastructure with local expertise to identify prudent investment opportunities across regions, industries, and issuers and to bring the Vanguard way of investing to clients around the world.

19/12

19 offices in 12 countries

50

More than 50 million clients

24/4

24 external advisors across 4 continents

All data as of May 31, 2023.

4 Source: Vanguard, as of May 31, 2023.

An unwavering focus

In doing so, we don’t take unnecessary risks with our investors’ hard-earned money for the possibility of short-term gains. We build accountability into our process by tying portfolio managers’ compensation to the performance of the funds they oversee. And we attract the industry’s most talented professionals who want to work in a collaborative and thoughtful environment where we care for our investors’ assets as if they were our own.

A community of investors

We believe in the possibility of a better future and take steps to make it a reality. Vanguard is here for those who see the world the way we do. We’re here for financial professionals who see the value in building relationships with people and caring for their investments. We’re here for people who want to feel confident about tomorrow without losing sight of what is important today. We’re here for those who serve as fiduciaries for their organizations, and we genuinely empathize with the employees who will someday retire from those organizations.

No matter what people invest for, Vanguard is where investors come first.

Notas:

Toda inversión está sujeta a riesgos, incluida la posible pérdida del dinero invertido.

Las inversiones en bonos están sujetas a riesgos de tasa de interés, crédito e inflación.

Las acciones de Vanguard ETF no se pueden canjear con el fondo emisor, salvo en grandes cantidades por valor de millones de dólares. En su lugar, los inversores deben comprar y vender acciones de Vanguard ETF en el mercado secundario y mantener dichas acciones en una cuenta de corretaje. Al hacerlo, el inversor puede incurrir en comisiones de corretaje y puede pagar más del valor del activo neto al comprar y recibir menos del valor del activo neto al vender.